Canadian Seed Sector Satisfaction with Royalties and Regulations

In this Making Waves post, researchers Rim Lassoued and Stuart Smyth report on the opinions of prairie seed growers regarding seed regulation.

By Dr. Rim Lassoued, Professional Research Associate, College of Agriculture and Bioresources, University of Saskatchewan; and Dr. Stuart Smyth, Associate Professor, Department of Agricultural and Resource Economics, University of SaskatchewanCanada is an innovative producer and competitive global exporter of high-quality cereals, pulses and oilseeds. The certified seed sector contributes over C$6 billion in annual economic activity and exports more than C$640 million annually.[1] Most of the seed production is concentrated in the Canadian prairie provinces of Alberta, Saskatchewan and Manitoba.

The certified seed sector is also a key driver of agricultural innovation. Commercialization of new crop varieties greatly contributes to increased food production and improves global food security. Both public and private research and development (R&D) results in new plant varieties with improved agronomic and quality traits. As a result, the number of plant variety protection (PVP) certificates that provide legal protection to new varieties has increased.

Canada’s Plant Breeders’ Rights Act is the main regulatory framework for governance of intellectual property rights (IPRs), and provides individuals, companies and institutions with a mechanism by which they receive royalties for their plant breeding investments. The PBR Act gives breeders exclusive rights to propagate and distribute material they register as a protected plant variety: no sale of seed is permitted without authorization from the holder of the protected variety. In order to qualify for protection, the variety must be new, distinct, uniform and stable (NDUS) in terms of genetic, morphological and agronomic traits.

To encourage additional investments in plant breeding and incentivize private R&D, Canada, as a member of the International Union for the Protection of New Plant Varieties (UPOV), amended its Plant Breeders’ Rights Act in 2015 to conform to the 1991 UPOV Convention (UPOV-91). UPOV-91 grants stronger variety protection for plant breeders while preserving Farmers’ Privilege under which farmers can save and sow their own seed of PBR-protected varieties (Government of Canada, 2014). While Canada is ranked in 16th place globally for innovation, it ranks 23rd in terms of knowledge and technology outputs (WIPO, 2021). A long-standing criticism of Canadian R&D is that while Canada is a leader in R&D investments, it suffers significant lags in terms of commercialized outputs. Adopting UPOV-91 was expected to increase R&D investments in agriculture, but a 2018 assessment found very little impact on increased investment in Canadian plant breeding (Sutherland et al., 2021). A subsequent survey in 2022, found that 72% of plant breeders indicated that the adoption of UPOV-91 increased their R&D investments (Macall et al., 2022).

We conducted a survey of seed growers in Western Canada to learn about issues important to the seed sector. The paper focuses on reporting opinions of prairies seed growers regarding seed regulation. The results cover a sample of 155 respondents, 32% of them located in Alberta, 40% in Saskatchewan and 28% in Manitoba. Surveyed seed producers grow mainly cereals (91%), pulses (71%), oilseeds (38%) and forages (18%).

Performance of the Royalty System

Royalties are payments that owners of intellectual property, such as PBRs holders, are legally entitled to as a condition of access to the seed. Farmers pay a royalty when purchasing new seed of PBR-protected varieties (certified seed). Surveyed seed growers were asked about their satisfaction level with the current royalty assessment system for the varieties they produce. Table 1 shows that the neutral response (Neither dissatisfied nor satisfied) accounts for the leading response rate for cereals, oilseeds, and forages. The greatest degree of dissatisfaction is for royalty rates for oilseeds.

Table 1: Surveyed seed producer’ satisfaction level with royalty rates (% responses)

| Crop Type | n | Very dissatisfied | Dissatisfied | Neither dissatisfied or satisfied | Satisfied | Very Satisfied |

| Cereals | 138 | 10 | 16 | 39 | 32 | 3 |

| Pulses | 106 | 9 | 11 | 38 | 35 | 7 |

| Oilseeds | 59 | 18 | 16 | 35 | 27 | 4 |

| Forages | 34 | - | 5 | 62 | 24 | 9 |

|

Note: Each row sums up to 100%. Bold values are the largest responses. |

||||||

In 2019, Agriculture and Agri-Food Canada (AAFC), started consultations about setting up a system that requires farmers who plant new cereal varieties, including farm-saved seed, to pay an annual royalty. These additional payments will be used to fund private investment in plant breeding. Farmers had to choose between two options for farm-saved seed royalty systems:

- End Point Royalties—paid on the crop produced from farm-saved seed; or

- Trailing Contracts—royalty paid on farmer-saved seed planted each year.

Under the end point royalty mechanism, farmers would be charged a per tonne royalty on their harvested crops if they grow a newer variety. Under trailing contracts, a standard minimum royalty rate would be mandatory for seed purchases of UPOV-91 varieties. It is estimated that a trailing royalty on farm-saved wheat seed of 50 cents to $1 an acre would add $250 to $500 in extra costs to an average 1,700-acre farm in Saskatchewan (Dawson, 2018).

Our survey results show that 40% of the sample of seed growers participated in the public consultation on the royalty collection options on UPOV-91 PBR varieties. Among them, 40% think that the adoption of end-point royalties would benefit their operation and 34% think that trailing royalties would do so (Table 2). Those divided opinions are similar to those generated from the AAFC’s consultation where farmers fell into (i) those who oppose the two proposed royalty options in favor of continuing publicly funded plant breeding; (ii) those who support one or both royalties, (iii) and those who encourage further plant breeding but are unsure about the role of private companies (Dawson, 2018).

Table 2: Types of royalties benefiting seed growers’ operation (% responses)

| End-point royalty | Trailing royalty | |

| No | 35 | 47 |

| Yes | 40 | 34 |

| I don't know | 25 | 19 |

Similar to royalty rates, most surveyed seed growers were neutral or satisfied with the cost of seed crop inspection regardless of the crop type they produce (Table 3).

Table 3: Seed growers’ satisfaction with the cost of seed crop inspection (% responses)

| Crop Type | n | Very dissatisfied | Dissatisfied | Neither dissatisfied or satisfied | Satisfied | Very Satisfied |

| Cereals | 138 | 5 | 11 | 33 | 44 | 7 |

| Pulses | 106 | 5 | 8 | 40 | 39 | 8 |

| Oilseeds | 59 | 7 | 2 | 31 | 49 | 11 |

| Forages | 34 | 9 | - | 43 | 38 | 10 |

|

Note: Each row sums up to 100%. Bold values are the largest responses. |

||||||

One external cost is crop insurance premiums on the pedigree seed produced. We found that 48% of the sample of seed growers were are not satisfied with the rates while 33% reported they were satisfied with the rates they are getting.[2]

Seed Regulation and Trust

In Canada, the CFIA is the certifying federal agency responsible for the administration and enforcement of the Seeds Act—that sets out the broad parameters of Canada’s seed regulatory framework and the Seeds Regulations. Both the Seeds Act and Seeds Regulations aim at protecting producers and consumers from fraud and low quality seed by setting seed grade standards and establishing variety registration protocols that breeders need to follow when developing new varieties (Government of Canada, 2021). Established in 1904, the Canadian Seed Growers’ Association (CSGA) is the national body responsible for prescribing varietal purity standards and certifying all agricultural crops, except potatoes, as per the federal Seeds Act and Regulations. Since its establishment in 1905, both the Seeds Act and Seeds Regulations have undergone occasional amendments. Eighty-six percent of respondents believe the current seed regulatory requirements do not limit their ability to produce new seed varieties. Only 14% indicated that seed requirements are moderately or highly limiting factors to their business.

A review is being conducted that spans 2021-2023 to modernize seed regulations (Government of Canada, 2021). The seed regulatory modernization (SEED-RM) process aims to better understand what amendments are needed to improve the Seeds Regulations. The CFIA conducted the SEED-RM Needs Assessment Survey between January and March 2021, targeting a number of stakeholders including seed growers and seed companies. That survey reported that respondents were generally satisfied with the Seeds Regulations, while supporting some changes to improve the existing rules (Canadian Food Inspection Agency, 2022). Forty-four percent of surveyed seed producers indicated that they participated in the federal survey, 48% did not and 8% said they don’t know. Forty percent of the participants think that the outcomes of the assessment will meet their needs while 42% are uncertain.[3]

As to information trust, results in Table 4 show that surveyed participants trust mostly other seed growers and the CSGA as reliable sources of information related to their business. Grain markets, agricultural media, social media, and farm trade shows are the least trusted sources of information about seed certification. Trust in media as a source of information has been largely declining. Certified agronomists and inspectors, seed companies, the Crop Development Centre and AAFC are moderately trusted.

Table 4: Trusted sources of information about seed certification among surveyed seed producers (% responses)

| Source of information | Slightly trust | Moderately trust | Highly trust |

| Other seed growers | 8 | 36 | 56 |

| Certified agronomists/agrologists | 24 | 52 | 24 |

| Third-party certified inspectors | 12 | 55 | 33 |

| Seed companies/distributors | 39 | 45 | 16 |

| Crop Development Centre | 11 | 47 | 42 |

| Agriculture and Agri-Food Canada | 13 | 48 | 39 |

| Grain marketers/buyers | 66 | 32 | 2 |

| Ag media (radio, TV, newspapers, magazines) | 68 | 29 | 3 |

| Social media | 76 | 24 | - |

| Farm trade shows | 51 | 46 | 3 |

| Canadian Seed Growers’ Association | 9 | 38 | 53 |

|

Note: Each row sums up to 100%. Bold values are the largest responses. |

|||

Survey respondents indicated that they interact less than once a year (44%), once a year (15%) or more than once a year (20%) with plant breeders to share information about what traits are most desired by farmers. Only 21% indicated that they never did so.

Seed Business Challenges

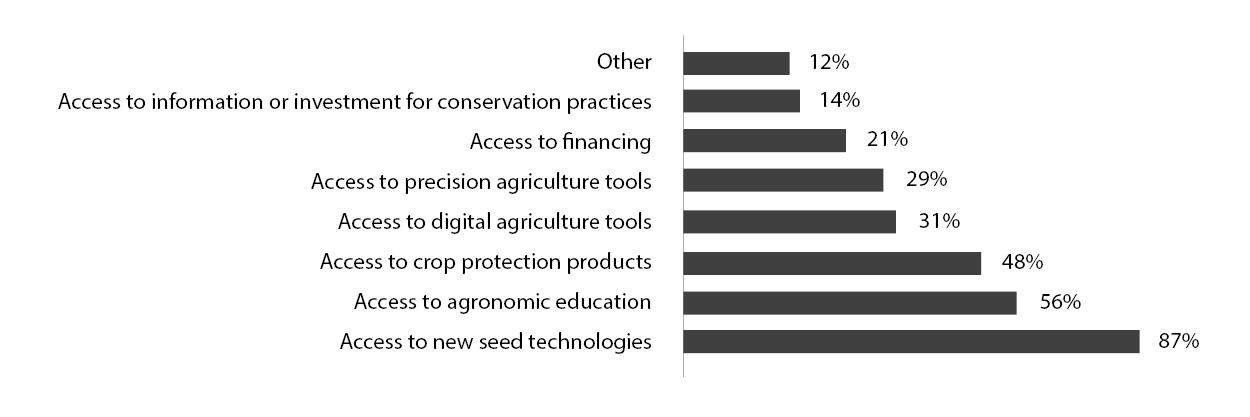

Results displayed in Figure 1 show that access to new seed technologies (87%), agronomic education (56%), and crop protection products (48%) are the three top challenges for surveyed seed growers’ operations. At least a quarter of the sample indicated that access to precision agriculture (e.g. variable rate planters) and to digital tools (e.g., farm management system, scouting) are also key to improving their business. Some participants (12%) noted lack of access to more varieties (as most existing ones are proprietary), third-party evaluation of new varieties trials before registration, access to data from provincial variety trials, and more R&D were also impediments to their business. Some growers pointed to the high up-front costs that prohibit small companies from accessing certain crop classes.

Figure 1: Seed business challenges

Summary

The seed system is key to sustaining food production in a changing climate, yet it remains complex. The CFIA’s initiative to amend the seed regulation is a good step to respond to some issues. The results will determine how Canada’s seed system will change and to what degree the government or industry will be responsible for regulating aspects of the Canadian seed sector. There is no doubt that regulatory changes should take into account farmers’ priorities. Farmers who nurtured plant diversity by breeding and saving seeds to sustain communities were the first to develop seed systems. Modernization efforts should not result in eliminating or privatizing key public protections and services that benefit farmers including seed growers.

Endnotes

[1] https://seeds-canada.ca/en/seed-resources/industry/.

[2] 19% selected “N/A”

[3] 14% and 4% answered: “Not at all” and “To a great extent”, respectively.

References

Canadian Food Inspection Agency. 2022. What we heard report: Consultation on the seed regulatory modernization needs assessment survey for seeds and seed potatoes [Online]. Available: https://inspection.canada.ca/about-cfia/transparency/consultations-and-engagement/what-we-heard-report/eng/1639504795130/1639504795539?wbdisable=true [Accessed 04/26/2022].

Dawson, A. 2018. Seed royalty meeting leaves unanswered questions [Online]. Manitoba Co-operator. Available: https://www.manitobacooperator.ca/news-opinion/news/royalty-meeting-leaves-unanswered-questions/#_ga=2.56889770.1293065689.1650909165-501371296.1650909165 [Accesssed on: 04/26/2022] [Accessed].

Government of Canada. 2014. Archived - Questions and Answers: Agricultural Growth Act: Updating the Plant Breeders' Rights Act in Canada [Online]. https://inspection.canada.ca/plant-varieties/plant-breeders-rights/overview/q-a/eng/1386443790655/1567629369415 (Accessed October 2021). [Accessed 01/15/2022].

Government of Canada. 2021. Seed regulatory modernization [Online]. https://inspection.canada.ca/plant-health/seeds/seed-regulatory-modernization/eng/1610723659167/1610723659636. [Accessed 02/15/2022].

Macall D., P. W. B. Phillips & S. J. Smyth. 2022. Impacts of Changes to Canada's Plant Breeders' Rights Act. Report submitted to AAFC.

Sutherland, C., Macall, D. & Smyth, S. 2021. Canadian plant breeder opinions regarding changes to plant breeders’ rights. Journal of Plant Breeding and Crop Science, 13, 46-57. doi:https://doi.org/10.5897/JPBCS2020.0936

WIPO. 2021. Global Innovation Index 2021: Canada [Online]. Available: https://www.wipo.int/edocs/pubdocs/en/wipo_pub_gii_2021/ca.pdf [Accessed 10/08/2022].