Assessing the Privatization of Retail Alcohol Sales

Control and regulation of alcohol by governments has a long and varied history in Western Canada. In fact, it traces back to even before there were provinces, to the time when the Northwest Territories were controlled by Canada’s Parliament. With liquor laws eventually coming under provincial jurisdiction, it’s not surprising policies have evolved to the point where the provinces of Western Canada take different approaches to balancing the benefits of liberal alcohol policy and the social harm alcohol abuse causes. Finding the right policy prescription is an on-going challenge.

By Jason Childs, Associate Professor, Department of Economics, University of Regina Alexander Siebert, Master’s student, University of ReginaCurrently, provincial governments are exploring options for managing the retail sale of beverage alcohol. Saskatchewan’s government, in particular, has changed and is considering further changes to the degree of private sector involvement in the retail market. The policy question is how would increasing the number and role of private sector retailers affect the balance between costs and benefits of alcohol policy? The experiences of other Western provinces can provide insight.

Assessing impacts as wide-ranging and complex as alcohol retailing policy requires a more nuanced approach than a single dimensional benefit-cost analysis. One dimensional benefit-cost analyses require subjective judgments concerning the relative importance of benefits and costs accruing to different groups. Rather than attempting to determine the appropriate relative value of different members of society, based on their interactions with liquor retailing, we adapt the balanced score card approach to assess the likely impacts of privatization.

The Balanced Scoreboard

Our analysis assesses the likely effect of liquor retail privatization in four ways, each representing a different group of alcohol policy stakeholders:

- First is the impact of privatization on the indirect costs of alcohol consumption and abuse which accrue to society at large;

- Second is the impact privatization is likely to have on provincial government revenues;

- Third, the impact privatization is likely to have on consumer welfare; specifically retail price and choice is examined; and,

- Fourth, the impact privatization is likely to have on those employed in this retail sector.

No attempt is made to consolidate the effects across these four measurements into a single number as this would require making value judgments on the relative importance of different groups of people.

Alcohol Retailing in Western Canada

The Western provinces of British Columbia, Alberta, Saskatchewan and Manitoba have taken different approaches to regulating the retail market for alcohol. Alberta’s market is entirely run by the private sector. British Columbia, Saskatchewan, and Manitoba have hybrid systems with both privately run and liquor-authority run retail outlets. Of those three provinces, British Columbia makes the most use of private retailers.

We examine these differences to assess the impact of privatization on those provinces with primarily government-run retail markets for alcohol based on the four-dimension analysis.

Indirect Costs of Alcohol

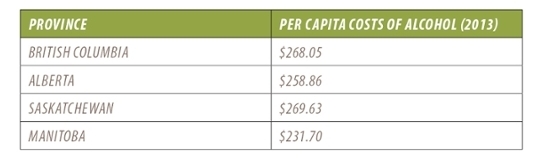

Alcohol consumption, particularly abuse, causes harm not just to those who consume it. These societal costs include increased expenditures on law enforcement and health care. Table 1 shows the estimated indirect costs of alcohol consumption in each Western Canadian province for 2013 based on Rehm, et al. (2006)1.

No clear link between privatization and the indirect costs of alcohol consumption can be discerned from these estimates. If there were a simple link between privatization and indirect costs, Manitoba and Saskatchewan would have very similar costs, with British Columbia being slightly different, and Alberta being noticeably distinct. However, Saskatchewan’s hybrid system yielded the greatest cost per capita while Manitoba’s very similar system produced the lowest cost per capita. Thus, based on the four-province comparison, there is no correlation between retail privatization and the indirect costs of alcohol consumption and any differences are driven by something other than the degree of retail privatization. While government policy is required to help reduce the harm caused by alcohol abuse, it appears liquor authority-run retail outlets need not be part of that policy mix.

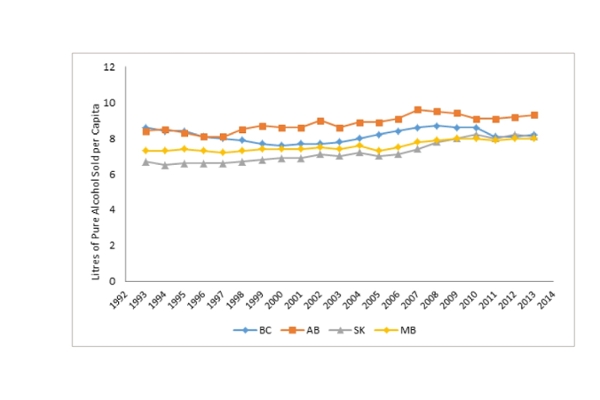

Indirect costs per capita are dependent on changing patterns of consumption. Figure 1 shows litres of pure alcohol sold per capita from 1993 to 2013. While we see higher initial levels of consumption in British Columbia and Alberta, all four Western provinces appear to be converging to a common level of consumption, with Alberta remaining slightly higher.

Government Revenue

Costs of alcohol to the health care system and law enforcement place demands on provincial coffers. To reduce the impact on provincial treasuries, all provincial governments in Canada tax and mark-up alcohol in their jurisdictions. As taxation is not linked to the ownership of retail outlets, we focus on the mark-ups levied by each Western province’s liquor-control authority, which are legally distinct from taxes. Net income of Western Canadian provincial liquor authorities was $2.15 billion in 2013.

There are two elements to examine when considering the impact of private alcohol retailing on government revenues; the revenue generated per litre of pure alcohol sold, and revenue generated per dollar spent by consumers. Both measures assess the ability of the liquor authority to generate revenue for harm mitigation.

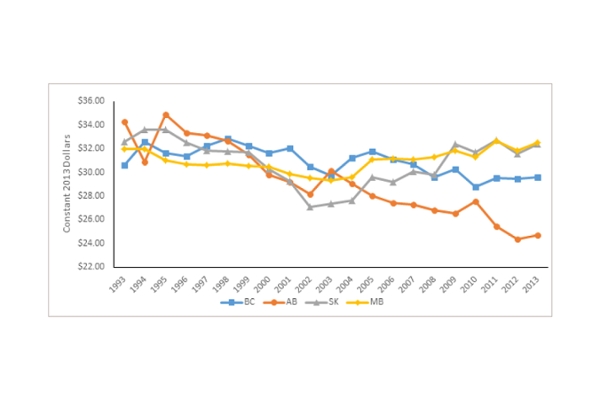

Figure 2 below shows revenue of liquor authorities per litre of pure alcohol sold for 1993 to 2013.

The experience of Alberta’s liquor control authority over these twenty years is of interest. Alberta fully privatized alcohol retailing in 1993 to 1994, with the final government run stores closing on March 5th, 1994. Immediately following privatization, Alberta saw a significant jump in revenue received by the liquor authority, but these gains were quickly lost as revenues per litre of alcohol sold fell until 2002. In 2002 Alberta increased its mark-up and saw a temporary jump in revenue per litre. In 2013 Alberta’s liquor authority captures the least per litre of any of the Western provinces.

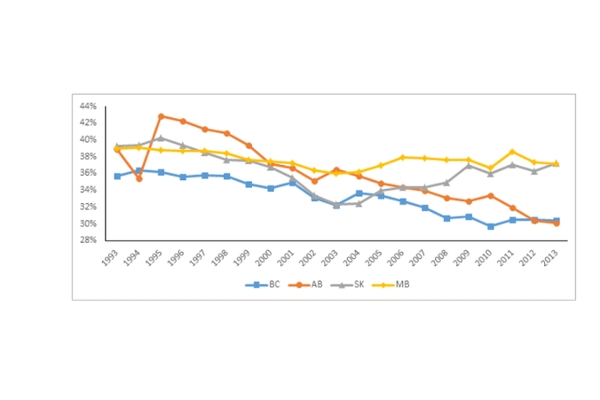

Figure 3 shows the portion of every dollar spent on alcohol that goes to each provinces’ liquor authority from 1993 to 2013.

Again, Alberta sees an increase in the share of consumer spending on alcohol captured by government in 1995 and then a decline in every subsequent year, except 2003 and 2010. British Columbia’s liquor authority has also seen its revenue per dollar spent on alcohol fall in line with Alberta’s.

In the case of Alberta the decline in revenue, particularly revenue per dollar spent, can be explained by two factors: lobbying on the part of private retailers and the mark-up structure adopted at the time of privatization. By privatizing alcohol retailing Alberta created a concentrated group with the incentive and resources to lobby for lower alcohol mark-ups. A diffuse group of consumers, who see themselves as benefiting from government spending, was replaced by a small concentrated group motivated by profits. Such a change begets effective lobbying.

Further, Alberta switched from marking up alcohol on a value-added basis to a flat per unit rate. This change has two important effects. First, unless the mark-up is constantly adjusted, the share of spending on alcohol received by the provincial government will decline over time due to inflation. Second, by marking up alcohol on a per-unit basis, Alberta’s liquor authority foregoes the additional revenue an ad valorem mark-up would generate when consumers switch to higher priced goods as they become wealthier. With a per unit mark-up the revenue received by the liquor authority is the same on a $10 bottle of wine as on a $20 bottle. With an ad valorem mark-up the portion of revenue received by the liquor authority remains constant (the number of total dollars received increases however) as incomes grow and consumers trade up to higher quality products. Moreover, flat per unit mark-ups add an element of regressiveness to revenue generation as lower-income people, opting for lower cost products, contribute a greater share of their spending to government.

Consumer Benefit

Much of the research concerning alcohol policy ignores benefits to consumers. Central to these benefits is the price consumers pay for alcohol and the selection of beverages available. Privatization may impact both.

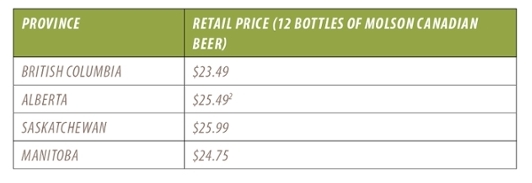

Price paid is a key consideration to consumers. While the bulk of the price consumers pay for alcohol is mark-up and taxation, retail providers can make a difference. To assess the impact of privatization on retail price we examine a representative product; one dozen bottles of Molson Canadian beer (produced by Molson-Coors and available in all four jurisdictions).

Based on the pricing of this product, there is no clear link between retail price and the degree of privatization. British Columbia’s system delivers the lowest price while Saskatchewan’s maintains the highest price.

The Consumer Price Index’s alcoholic beverage category tells a similar story, with prices increasing the most in Alberta and the least in British Columbia.

Albertans with entirely private retail markets have endured the most price increases, while British Columbia’s highly privatized hybrid system delivered relatively stable prices. Thus, there is no reason to believe privatization in and of itself will lead to lower prices.

Selection of products offers a clearer distinction between private and government run retail outlets. Unfortunately, the number of different products available in British Columbia’s retail liquor outlets is not available. The offerings in the remaining provinces are illustrative.

The difference in consumer choice between the provinces for which data is available shows a strong link between privatization and product selection. Consumers in Saskatchewan and Manitoba can expect to see a significant increase in selection should privatization occur.

Impact on Employees

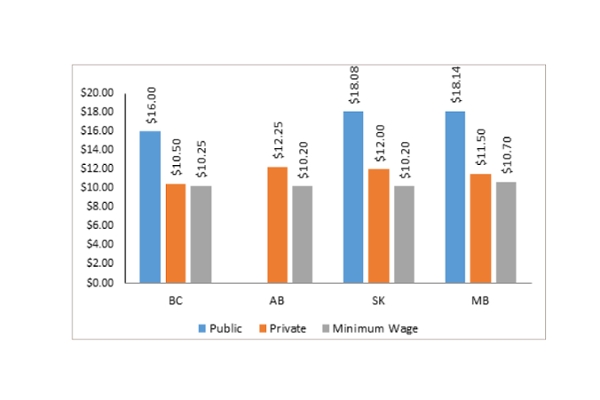

The impact of privatization on those currently and potentially employed in alcohol retailing must be considered. Privatization may impact employees’ wages and the number of jobs available in the sector.

On this point, the evidence is clear: Employees of public sector alcohol retailers are paid significantly more than those in the private sector.

Clearly, privatization will result in lower pay.

But, at the same time, based on the Alberta experience, employment opportunities will increase as a result of privatization. Since privatization in 1993 the number of retail outlets in Alberta has grown more than 500 percent3. Such an increase in the number of outlets means significantly greater employment (West, 2003).

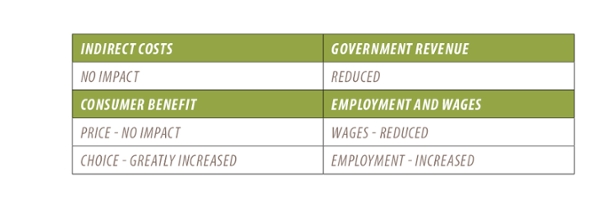

So, to summarize the impacts based on our analysis of the four western provinces:

The balanced score shows that privatization as undertaken in Alberta and British Columbia involves a trade-off between increased consumer choice and higher employment versus lower wages in the sector and decreased government revenue from alcohol sales. The relative importance of each is a subjective decision.

3 Alberta Liquor and Gaming website.

Policy Options

Status Quo with Improved Service

Both Saskatchewan and Manitoba can continue with their current hybrid system in which the most profitable locations are run as liquor authority stores, with the private sector running off-sales and rural outlets. This system generates more revenue per dollar spent on alcohol than Alberta-style privatization and higher wages for those employed in their liquor authority’s retail operation. But it comes at the expense of consumer choice and demand for government capital, as new stores are required to maintain service when populations grow and shift, as well as reduced overall employment in liquor retailing. Liquor authorities opting to continue with this model should improve the quality of retail outlets and choice offered to consumers.

Simple Privatization

Saskatchewan and Manitoba could adopt simple privatization, in which the liquor authority leaves retail sales to the private sector. As implemented in Alberta this method has the potential to create an effective lobby for lower mark-ups on alcohol without lower retail prices4. This system generates greater selection and retail employment.

Best Practice

Learning from the experiences of Alberta and B.C., Saskatchewan and Manitoba could adopt the best practices from jurisdictions beyond Western Canada and from outside the alcohol retail sector. Two key changes to the privatization method would help resolve the revenue loss due to effective lobbying seen in Alberta, while absolving the liquor authorities of further capital investment in retail operations and increasing consumer choice:

- First, any future privatization should forgo the requirement for stand-alone stores. This has been done very effectively in Nova Scotia where liquor authority stores share buildings with supermarkets. By lowering overhead costs, lobbyists have fewer arguments for lower mark-ups.

- Second, once areas in which stores are to be located have been identified, the liquor authority should auction the rights to run a store for a set period of time (ten years, for example) in the same way telecommunications spectrum is auctioned. This method would allow for additional revenue to be generated by the liquor authorities. In the example of the federal government’s most recent spectrum auction, $2 to 3 billion in revenue was generated.

- Third, the mark-up on alcohol should be on a value-added basis for all products so that government revenue moves in step with consumer preferences for more expensive products.

A change in the policies governing the retail sale of alcohol has the potential to be a boon to consumers, government revenues, and potential employees, provided best practices from other jurisdictions and industries are used to balance the potential losses of any change.

Reference

1 Rehm et al (2006) estimate the total costs of alcohol consumption for each province in 2002. We calculate the cost per litre of pure alcohol sold per capita, convert to 2013 dollars, and multiply by 2013 sales of pure alcohol per capita in each province.

2 As Alberta’s retail system is entirely private this price is subject to significant variation between retailers and over time. This value was taken from Liquor Direct’s website in May, 2015. Liquor Direct operates over 170 stores across Alberta.

3 Alberta Liquor and Gaming website.

4 It should be noted that Alberta’s system is likely to be as effective as Saskatchewan’s at reducing consumption through higher prices on alcohol as both provinces have comparable retail prices.

Works Cited

Commission, A. L. (2015, 08 06). Liquor History and Facts. Retrieved from Alberta Liquor and Gaming Commission: http://aglc.ca/liquor/liquorhistoryandfacts.asp

Rehm, J., Gnam, W., Popova, S., Baliunas, D., Brochu, S., Fischer, B., & Taylor, B. (2006). The Costs of Alcohol, Illegal Drugs, and Tobacco in Canada, 2002. Journal of Studies on Alcohol and Drugs.

West, D. (2003). The Privatization of Liquor Retailing in Alberta. The Fraser Institute.

Jason Childs

Jason Childs is an associate professor of Economics at the University of Regina. An expert in experimental/behavioural economics, Dr. Childs is currently researching the economic determinants for alcoholic beverages in Canada, as well as the dynamic instability of the elasticity of demand for alcoholic beverages in Canada. He is the author of 10 peer reviewed papers and three books.

Alexander Siebert

Alexander Siebert is studying for a Masters of Arts in Applied Economics and Policy Analysis at the University of Regina. He was the winner of the Alex Kelly Economics Essay Award.

People who are passionate about public policy know that the Province of Saskatchewan has pioneered some of Canada’s major policy innovations. The two distinguished public servants after whom the school is named, Albert W. Johnson and Thomas K. Shoyama, used their practical and theoretical knowledge to challenge existing policies and practices, as well as to explore new policies and organizational forms. Earning the label, “the Greatest Generation,” they and their colleagues became part of a group of modernizers who saw government as a positive catalyst of change in post-war Canada. They created a legacy of achievement in public administration and professionalism in public service that remains a continuing inspiration for public servants in Saskatchewan and across the country. The Johnson-Shoyama Graduate School of Public Policy is proud to carry on the tradition by educating students interested in and devoted to advancing public value.