Greenhouse Gas Emissions Reductions in Canada Through Electrification of Energy Services

Mitigating climate change is one of the most sophisticated challenges of our time. Governments across the world – including Canada – began to tackle climate change and work to achieve their greenhouse gas (GHG) targets to stabilize the global temperature at 1.5 C above pre-industrial levels.

By Allan Fogwill, President and CEO, Canadian Energy Research Institute; and Rimgaile Baliunaite, Head of Electricity Division, National Commission for Energy Control and PricesMitigating climate change is one of the most sophisticated challenges of our time. Governments across the world – including Canada – began to tackle climate change and work to achieve their greenhouse gas (GHG) targets to stabilize the global temperature at 1.5 C above pre-industrial levels. Accordingly, as was announced by a joint federal-provincial declaration (Vancouver Declaration on Clean Growth and Climate Change) in 2016, Canada set a target to reduce GHG emissions by 30 per cent below 2005 levels by 2030. Canada’s 2050 reduction target is set at 80 per cent below 2005 levels. Therefore, achieving these emissions reduction goals requires immense demand for cleaner technologies, transformational solutions for energy procurement and consumption, as well as existing and new infrastructure.

Electricity has a crucial role in achieving economy-wide deeper emissions reductions. It is a highly versatile form of energy and converting electricity into end-use energy services can be done at high efficiencies. An economy-wide transition from the current energy end-use fuel mix to one dominated by electricity is an option to satisfy future energy demands, while achieving deep GHG gas emissions reductions. Through electrification, emissions can be moved from some millions of spatially dispersed sources such as vehicles and building sources to several hundred point sources (i.e., electric power generating units), making the emissions reduction more manageable. Furthermore, proven technology exists – for example, renewable and nuclear power – to produce electricity with zero GHG emissions.

Transitioning to an energy system with electricity as the dominant end-use energy source requires changing the existing infrastructure stock – vehicle fleets, buildings, equipment and distribution networks – across all sectors of the economy. Additionally, it requires much larger electricity generation and transmission infrastructure than today. That would inevitably have significant economic impacts resulting from new investments, stranded assets, and changes to energy markets. As such, to set up a realistic technology and policy road map to deploy electrification as a climate change mitigation strategy, it is important to gain insights into those complicating factors through analyses that explicitly model those factors with sufficient spatial, sectoral, and temporal granularity.

Accordingly, there is debate in Canada right now about the transition to a lower-carbon economy. This is in part a result of different perspectives regarding the cost and complications of moving away from traditional energy sources. One option for the transition is to use electricity for all end uses in the residential, commercial, industrial and transportation sectors. The Canadian Energy Research Institute (CERI) undertook an analysis to determine the impacts of electrifying the residential, commercialand passenger transportation sectors of 10 Canadian provinces. Industry and freight transportation are more complicated sectors to assess, so those were left out of our analysis for now, as were the three territories, which have more unique energy requirements.

We wanted to know how effective these sectors could be in helping Canada meet its 2030 and 2050 carbon dioxide reduction targets. Our research sought answers to three questions:

- What major transitions in energy systems are required to electrify the end-use energy services of residential, commercial, and passenger transportations sectors?

- What level of emissions reductions can be achieved through electrification of these energy services?

- What would it cost?

We compared our electrification scenario to business as usual (BAU). Under this scenario electric equipment replaces natural gas equipment in the residential and commercial sectors through the normal retirement and replacement cycle. One exception is the predominant fuel being replaced in Atlantic Canada is heating oil, not natural gas. The BAU scenario to 2050 shows that total energy demand in the residential sector grows, depending on the province, from 5 per cent (in Quebec) to almost 68 per cent (in Alberta). In the Atlantic provinces, residential sector demand drops by 13 per cent over the same period. The electrification scenario assumed no change to energy demand from conservation and efficiency programs. It does incorporate the inherent efficiency of moving from existing energy consuming equipment to their electrical counterparts.

We also replaced gasoline and diesel passenger vehicles with electric cars. The timeline for replacement started farther out in our review period due to the still-developing nature of electric-car technologies.

Improved Efficiencies

We find that electrification will significantly improve the efficiency of end-use energy conversions due to the higher efficiencies of electrical devices. We find that under electrification, energy intensity of household energy usage drops by up to 30 per cent. More profound efficiency improvements are observed in the passenger transportation sector, where energy intensity is reduced by up to 71 per cent.

At the same time, the increased electricity demand provided by the grid, evolves into one with a high level of renewable (over 60 per cent) and other non-emitting generation options. The remainder of the electricity was produced with natural gas, or natural gas combined with carbon capture and storage.

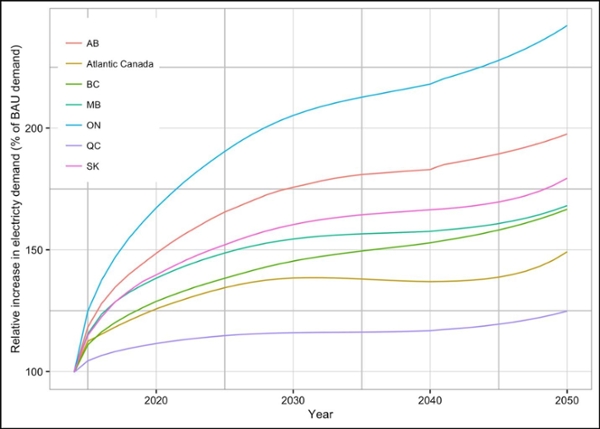

Figure 1 shows the relative growth in electricity demand compared to the BAU scenario in all provinces. Ontario sees the highest relative electricity demand growth compared to BAU where, by 2050, the electricity demand is almost 2.5 times that of BAU. This is mainly due to the higher population and associated building and transportation energy demand. Ontario is followed by Alberta, where 2050 demand is 2 times that of BAU. The lowest demand growth is observed in Quebec and the Atlantic provinces.

Quebec’s 2050 electricity demand is only 20 per cent higher than the BAU and this increase is driven predominantly by passenger transportation sector demand. The estimated cost of building and operating electric power systems under the electrification scenario is 1.5 to 3 times that of the BAU scenario. The highest total electricity sector cost was observed in Ontario and the lowest in Quebec. Our first observation from the analysis is that a significant move of energy services away from natural gas, gasoline, diesel and heating oil would suggest a significant drop in emissions. GHG emissions reductions from electrification of residential, commercial, and passenger transportation sectors over the analysis period (2020-2050) in all Canadian provinces are depicted in Table 1.

If we consider our 2030 target of 30 per cent below 2005 levels, we see that Atlantic Canada is 7 per cent below, Quebec 9 per cent, Ontario 14 per cent, Manitoba 11 per cent, Saskatchewan 8 per cent, Alberta 6 per cent, and BC 9 per cent. In 2050, the results are similar, additional reductions in emissions, but only a fraction of what is needed to achieve the 80 per cent reduction target.

Accordingly, the second observation is that electrification of residential, commercial, and passenger transportation sectors is not enough. The industrial and freight transportation sectors are significant in terms of GHG emissions and would need to be included to achieve Canada’s emissions reduction goals.

The third observation is that higher investment and operating costs will inevitably lead to higher average retail prices of electricity. We estimated the increase in average price to be 16-77 per cent in 2050 depending on the province. Keep in mind this is the additional price increase above an annual 2 per cent increase due to inflation. GHG emissions abatement cost of electrification is lower ($14-$38/tCO2eq) in Quebec, Manitoba, British Columbia and the Atlantic provinces.

Abatement costs are higher in Alberta, Ontario, and Saskatchewan. It is over $100/tCO2eq in Alberta and Ontario. Availability of natural gas-fired generation with carbon capture and storage leads to 8-18% lower abatement cost compared to an electricity supply without that technology in those three provinces.

Table 1: GHG Emissions Reductions Achievable by Electrifying End-use Energy Demand of Residential, Commercial and Passenger Transportation Sectors of Canadian Provinces

| Emission Reduction (per cent of 2005 GHG emissions) |

GHG Emissions Abatement Cost ($/TC02EQ)ii |

||

| In 2030 | In 2050 | ||

| Atlantic Canada | 7 per cent | 13 per cent | 14 |

| Quebec | 9 per cent | 35 per cent | 36 |

| Ontario | 14 per cent | 31 per cent | 114 |

| Manitoba | 11 per cent | 24 per cent | 8 |

| Saskatchewan | 8 per cent | 16 per cent | 58 |

| Alberta | 6 per cent | 16 per cent | 176 |

| British Columbia | 9 per cent | 16 per cent | 13 |

ii Abatement cost is calculated based on cumulative emissions reduction in the period 2020-2050.

Source: CERI

Yearly Cost Increasse

Roughly, that means in addition to the usual increases we see in electricity rates of one to two per cent, we would see an additional two to three per cent increase each year for 30 years. Not large in and of themselves annually, but many electricity customers across the country are already concerned about affordability.

The fourth observation is that the increase in electricity demand is about two to three times what we use now. That means an equivalent expansion of the grid in each province of about two to three times. Renewable electricity generation options are at a lower energy density than fossil-based generation. Therefore, approximately two times more electricity demand will likely result in more than doubling of land-use requirements. The study did not quantify the additional land use based on lower density generation options much as solar and wind. For example, a city the size of Guelph, ON. could be served by a natural gas generator taking up the space of an average-sized warehouse. On the other hand, a solar array to serve the same city would consume approximately 6 sq. km.

While the study did not quantify the increase land use from low-density generation options, it also did not quantify the decrease in land use from a large use of distributed and embedded generation. These latter options can be deployed in urban areas thus reducing the land use requirements for grid-based generation and transmission.

Citizens are concerned about infrastructure being built anywhere near their communities, transit lines, transmission towers, pipelines and roads. This build out of the electricity system would be cause for concern. One solution to this however, is the extensive use of distributed and self-generation. While this option can help reduce the overall footprint of the expanded electricity grid, siting issues will remain a challenge.

The fifth observation is that with electrification in the residential and commercial sectors, the main fuel that gets replaced by electricity is natural gas. Natural gas is delivered to more than 6.6 million residential, commercial and institutional customers across Canada. The gas delivery system consists of over 450,000 kilometers of transmission and distribution pipelines, as well as above ground and underground storage facilities.2 The investment in this infrastructure will be stranded with electrification. For example, capital investments made by natural gas distribution utilities over the last 10 years is in the order of CAD $1.2 - $3 billion per year.3 Investment and operating cost of natural gas distribution infrastructure is recovered through regulated tariffs. In an electrification scenario, as customers move from natural gas to electricity services the remaining natural gas customers would see their prices (tariffs) increase quickly. Transition for those natural gas customers would need to be managed. Would they be expected to cover the remaining asset values? Also, a lower number of natural gas customers means lower natural gas consumption within the country. Could the surplus natural gas be exported to minimize or eliminate the loss of income by natural gas companies at the same time – reducing overall economic impact on regions which are dependent on natural gas production?

What would inevitably be stranded under the electrification scenario is new natural gas distribution networks that would be built after rolling out of economy-wide electrification as a climate change mitigation strategy. This emphasizes the importance of coordinating policy goals and physical investments. However, estimation of the exact value of the infrastructure that could potentially be stranded under large-scale electrification requires farther extensive analysis.

Passenger Transportation

Also, the sixth observation is that electrification of the passenger transportation sector has some unfavorable consequences since electricity mainly displaces gasoline. In this case, the current transportation fuel distribution and dispensing infrastructure can potentially be stranded. The most notable one is the network of filling stations. As of December 2014, there were approximately 17,200 gasoline stations in Canada. About 29 per cent of these stations had 1-5 employees and 70.9 per cent had more than 5 employees.4 These filling stations primarily serve personal transportation fuel demands. Under electrification of passenger transportation, these stations may lose the primary market they serve, depending on how the charging station infrastructure is developed. Therefore, this might be one of many ongoing structural labour market changes reshaping the employment landscape and leading to new challenges for the government. On the other hand, electrification of the passenger transportation sector also will require additional work force and, accordingly, create complementary job vacancies which could be filled by the retrained employees who, for example, previously worked in the transportation fuel distribution and dispensing infrastructure.

Finally, another impact of displacement of gasoline as transportation fuel is the potential loss of government tax revenues. There are several taxes – for example, federal excise tax, provincial fuel taxes, municipal transit taxes – that are enforced specifically on gasoline. Total taxes collected from gasoline sales to households (gasoline is purchased primarily as a transportation fuel) amounts to CAD $11 billion per year (highest in Ontario at approximately CAD $4.3 billion/year and lowest in Manitoba at about CAD $0.3 billion/year). Large scale electrification of passenger transportation would lead to a loss of these tax revenues with corresponding consequences to government budgets. Would these taxes be transferred to electricity consumers? Would that not mean a further increase in the price of electricity?

Conclusion

In summary, electrification of end-use energy services will make substantial changes in energy systems also energy sourcing and consumption behavior. However, the level of end-use energy services was assumed to remain unchanged. To achieve emissions reductions through electrification requires both transforming the end-use energy conversion infrastructure as well as decarbonizing the electricity supply. This requires coordinated efforts in policy, technology developments, and energy infrastructure deployments.

As noted, even a significant societal change toward electrification would be insufficient to meet the federal government goals. Additional efforts such as conservation and energy efficiency would be required, along with transitioning to lower-carbon energy in the industrial and freight transportation sectors. For the residential, commercial and passenger transportation sectors, society would have to consider changing the way some services are provided (e.g. moving from private to public transportation, or decreasing the living space per person). In terms of the industrial and freight transportation sectors, energy system transformations take on the added risk of potentially reducing economic activity and investment. While none of these additional options are without their challenges, they can be addressed with the appropriate public policy and regulatory instruments. The challenge continues to be summarized as whether the benefits of decarbonization outweigh the costs.

References

1 Greenhouse Gas Emissions Reductions in Canada Through Electrification of Energy Services. Canadian Energy Research Institute. Study No. 162. January 2017

2 Helping Middle Class Families, Growing the Economy, Driving Innovation - 2016 Pre-budget Submissions. Canadian Gas Association. Retrieved from http://www.parl.gc.ca/Content/HOC/Committee/421/FINA/Brief/BR8115793/br-external/CanadianGasAssociation-e.pdf

3 Statistics Canada. (2016). CANSIM Table 029-0046 Capital and repair expenditures by North American Industry Classification System (NAICS).

4 Gasoline Stations (NAICS 447): Establishments, Statistics Canada, https://www.ic.gc.ca/app/scr/sbms/sbb/cis/establishments.html?code=447&lang=eng.

For detailed information please visit http://www.ceri.ca/publication

Allan Fogwill

As the President and CEO of the Canadian Energy Research Institute (CERI), Allan Fogwill has over 25 years of experience as an energy executive in both the public and private sector. Mr. Fogwill’s background has focused on economic and market analysis of energy sector issues along with policy development related to energy regulation and efficiency issues. He has previously worked for natural gas distribution companies in BC and Ontario and for the Ontario Energy Board dealing with market analysis and the analysis of distribution costs. Prior to assuming his role at CERI, Fogwill provided regulatory consulting services to local distribution companies in Ontario. He has also served as the Chair and CEO of the Canadian Energy Efficiency Alliance and the Canadian Gas Research Institute.

Rimgaile Baliunaite

Rimgaile Baliunaite is the Head of Electricity Division of the National Commission for Energy Control and Prices (NCC), an independent national regulatory authority in Lithuania regulating activities of entities in the field of energy and carrying out the supervision of the state energy sector. She works on regulatory issues within the energy sector, and is currently focusing on monitoring and investigating the wholesale electricity market on a regional level in Europe. Recently, she held a brief appointment as a visiting researcher with the Canadian Energy Research Institute, and has served as the NCC’s Deputy Head of Law Division. Ms. Baliunaite has a master’s degree in European Business Law from the Mykolas Romeris University.