Reimagining a climate change future for Canada

This issue of JSGS Policy Brief is part of a series dedicated to exploring and providing evidence-based analysis, policy ideas, recommendations and research conclusions on the various dimensions of the pandemic, as it relates here in Canada and internationally.

By Dale Eisler, Senior Policy Fellow, Johnson Shoyama Graduate School of Public PolicyTrying to predict the future is part of the human condition. How else is one to explain the fixation we have on attempting to pronounce on what is going to happen? The time frame doesn’t much matter, as it can be next week, next month, or years hence. We all have a yearning to know the unknowable. The latest craze is what the post-COVID world is going to look like, and its less predictive and more prescriptive cousin—what it should look like.

There’s been a lot of that going around in recent weeks. In fact, you might say a cottage industry has emerged of people declaring informed insights and predictions of where we’re all headed, or at least in their opinion where we should be headed.

One of today’s more popular forecasting themes is how the pandemic and its economic consequences are going to shape, or should shape, the economy in the months and years ahead. In many cases, prognosticators are arguing the economy that emerges on the other side of the pandemic needs to be one that is designed to meet the other great crisis the world faces—climate change. In other words, the crisis that we’re struggling with now leads us to another we must address. It’s a bit of the old theory that you should never let a crisis go to waste.

The policy idea of a post-COVID economy that is shaped by pursuit of Canada’s climate change agenda makes good sense. We are clearly in the midst of an unparalleled global economic disruption. It might be self-imposed to meet our public health objectives, but that’s no reason not to seek the creative destruction that is the lifeforce of any dynamic and relatively free-functioning economy. Granted, our current economic state is the furthest one can image resulting from a “free-functioning” economy. It’s wholly artificially imposed, albeit for good reasons. Still, we have an opportunity to take advantage of the destruction by re-constructing our economy to meet climate change goals. A better-planned economy, or creative reconstruction, you might say. Some like to call it a “Green New Deal.”

Fair enough. But what does that actually mean?

In terms of climate change for Canada it means reducing our dependence on fossil fuels as part of a shift to renewable and non-emitting energy sources. There are calls for greater government intervention to chart a specific economic path for Canada, one where there is emphasis and incentives on a cleaner energy future. The right policy as the economic recovery takes hold can be critical in creating the conditions for Canada to meet its Paris agreement commitments and stated climate change goals. But in any significant economic change, there’s always a catch. It’s never costless. Inevitably there are winners and losers. In the case of energy, the effects of change on people will be significant, and in many cases painful. The policy challenge becomes how to manage the transition in a way that mitigates the pain, is the least disruptive to people, their livelihoods and their lives, as possible.

Economic implications

To give but one example, all you need to do is consider the cost to Canada of a weakened and diminishing oil and gas sector. There are the usual economic factors such as employment, or more to the point unemployment, loss of investment and the downstream supply chain effects across Canada that will have to be managed as we move to a “green energy economy”. The fact is that the oil and gas industry is the single largest economic sector in Canada. Moreover, oil and gas also form the largest export segment in the Canadian economy.

What does that mean specifically? It means many things. One is that in 2019 Canada was a net exporter of energy totalling $76 billion, which was an amount that fully covered Canadians $55 billion net imports of consumer goods and $11 billion in travel services. It means that in the first quarter of this year that, despite further weakening of oil prices, Canada was still a net exporter of $15 billion of crude oil, an amount that almost covered the cost of Canada’s combined net imports of $12 billion in consumer goods and $5 billion in motor vehicles.1 It also means significant shifts in employment, which is an anodyne way of saying unemployment. In 2018, more than 282,000 people worked in the energy sector and indirectly the sector supported more than 550,500 jobs.2 There were 200,453 who worked in mining and oil and gas extraction.3

The crucial economic role the oil and gas sector plays is self-evident, and not simply in provinces such as Alberta, Saskatchewan and Newfoundland and Labrador, where it accounted for $91.2 billion in GDP, but nationally.4 Beyond its leading role in export earnings, the sector is a major source of domestic revenue for all governments. From 2013-17, average annual revenue to federal and provincial governments was $16.8 billion.5

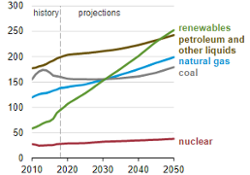

Given these facts, no serious person suggests there should be a rapid and sudden end of the oil and gas energy sector in Canada. The economic and social consequences would be too severe. As The Economist noted, what the COVID recession and the corresponding decline in emissions has taught us is the magnitude of the climate challenge. “It is much too large to be solved by the abandonment of planes, trains and automobiles. Even if people ensure huge changes in how they lead their lives, this sad experiment has shown, the world would still have more than 90 per cent of the necessary decarbonization left to get on track for the Paris agreement’s most ambitious goal.”6 Moreover, the International Energy Agency predicts—there’s that need to know the future again—increasing global oil demand for decades to come, but growing considerably more slowly through to 2050. As Fatih Birol, executive director of the Paris-based agency notes: “Demand growth is robust to 2025, but growth slows to a crawl thereafter.”7 The figure below shows the U.S. Energy Information Agency projections for global primary energy consumption.

Table 1: Global primary energy consumption 2010-2050, U.S. EIA, 2019 Quadrillion British thermal units

In recent months of the COVID induced economic shutdown, oil demand has fallen dramatically. In its May 2020 Oil Market Report, the IEA notes global oil supply was set “to fall by a spectacular 12 mb/d in May to a nine-year low of 88 mb/d.”8 This relationship between an economy in distress and plummeting demand for oil merely demonstrates the direct correlation between a strong economy and demand for oil. The climate change challenge is how to get one without the other.

In April, Canada’s trade deficit was $3.25 billion, in significant measure due to a record decline of 43.6 per cent in demand for oil exports because of the global economic recession.9 One of the consequences for Canada of a diminishing oil sector is a corresponding reduction in oil exports and the revenue they generate. Unless Canada has other exports to replace the loss of revenues from oil, the current account, or trade balance, effect on Canada will be a declining Canadian dollar. A weaker dollar is a recipe for inflation as the costs of imports rise proportional to the dollar’s decline. Conversely, assuming the price of oil continues to slowly recover as the economy comes out of its COVID-induced coma, it will have a positive effect on Canada’s current account deficit and the value of the Canadian dollar against other currencies.

So, in a scenario where we design an economy with an ever-diminishing role for the oil sector, it becomes a case of be careful what you wish for. That’s not to say the climate change agenda shouldn’t be an overriding objective in the economy of the future. It should be. But it needs to be done in a way that fully considers and deals with the scope of the consequences. Currently there is nothing on offer that can begin to replace oil as a source of export revenues. There is nothing exportable about renewable energy technology relating to solar, wind or battery sources. Canada has no comparative advantage in those sectors. Ours is an economy that has exploited its advantages in the export of natural resources that the world needs. In no small part, our standard of living and quality of life has been built on the role of Canada’s natural resource sector as a major engine of growth and source of export earnings. With oil being the single largest of those natural resource exports, losing that economic advantage will have major repercussions without something to take its place.

The challenge then, if we’re going to talk about the green energy future, is what could that be? The answer, surprisingly enough, is the energy sector, including the oil sector and other CO2 emitting industries.

It’s no coincidence that the oil and gas sector is a major investor in renewable and other clean energy initiatives. The reason is simple. Major oil companies, and in particular those operating in the oil sands, recognize the world is changing to a low carbon emission economy and they need to join in the transition and become part of the solution or go through a slow, painful and possibly terminal decline. For example, Suncor is investing $300 million in a 50,000-acre windfarm, and Canadian Natural Resources, Canada’s largest oil and gas company, has committed to a net-zero carbon emission future. The recent collapse of oil prices has understandably led many companies to cut their capital investment plans, but assuming a recovery that should change.10

Finding value in carbon

The question for government as it seeks to design a post-COVID economy that meets Canada’s climate change goals is how to do it in a way that makes the energy transition environmentally, economically and politically sustainable. It requires addressing head-on the fact that oil exports have been, and still are, crucial to a strong national economy and Canadian dollar. Key is finding ways to dramatically reduce CO2 emissions from fossil fuels as part of a clean energy agenda, while exploiting Canada’s massive oil deposits to produce new value-added products. One option in that equation is carbon capture, utilization and storage (CCUS), a process that eliminates emissions that would be released into the atmosphere and can be a crucial in unlocking non-emitting fuels from CO2 and producing valuable carbon-based products.

After a briefly flurry of interest a decade ago, followed by a period of neglect, CCUS is again attracting attention on the policy agenda. Many believe if Canada is going to meet its goal of a 30 per cent reduction in CO2 emissions from 2005 levels by 2030 and a net-aero economy by 2050, carbon capture needs to play a role. Clearly it is not a solution, but part of a multi-faceted remedy that also involves a movement to renewable energy, greater energy efficiency, expansion of clean power sources, and nature based carbon sinks. In spite of the policy neglect, there still has been significant progress in terms of carbon capture from industrial sources. Three major post-production carbon capture projects operating in western Canada include SaskPower’s Boundary Dam facility, the Shell Quest upgrader near Edmonton and the Alberta Carbon Trunk Line (ACTL), which became fully operational last month. The ACTL is a backbone for a system that captures carbon from industrial sources near Edmonton, including the Northwest Redwater Refinery and a fertilizer plant, and transports the CO2 to a gas compression facility that then stores the CO2 underground in depleted oil fields.

As well, Canada is attracting international attention for its advancements in direct air capture (DAC) technology. DAC extracts CO2 directly from the ambient air, addressing the “legacy” CO2 emissions that have accumulated in the atmosphere over many, many decades. British Columbia-based Carbon Engineering is considered a global leader in DAC and has attracted international funding, including from Bill Gates and major oil companies.

But carbon capture from fossil fuels goes beyond simply sequestering CO2 emissions. It is also essential in a value-chain process that includes using carbon to create new value-added products, such as lightweight carbon fibre material increasingly important for producing lighter vehicles (including EVs) and building materials that store rather than emit carbon in their fabrication. More critically, captured carbon is a source for the creation of non-CO2-emitting fuels such as hydrogen, through a process called chemical looping conversion.11 Noe van Hulst, chair of the IEA governing board in 2017-18 and a climate policy expert with the Government of the Netherlands, says that hydrogen will be critical in solving the need for a non-CO2 emitting transportation fuel. “There is growing international consensus that clean hydrogen will play a key role in the world’s transition to a sustainable energy future. It is crucial to help reduce carbon emissions from industry and heavy transport, and also to provide long-term energy storage at scale,” van Hulst says.12

It’s noteworthy that in recent years the U.S. has positioned itself at the forefront of CCUS. A key federal measure in the U.S. was what’s known as the 45Q tax incentive for carbon capture projects. Coupled with a federal loan guarantee program for new projects, significant investment has flowed into carbon capture. As of last November, with 10 large scale projects operating and several more in various stages of development, the U.S. had more than half of the major carbon capture projects in the world.13 Canada should be considering similar incentives to create an environment that will attract private investment into the carbon capture value stream, and as part of establishing a global leadership role in addressing climate change.

Conclusion

The challenge is evident. Canada needs to recognize the inherent strengths of an economy built in large measure on natural resource comparative advantage in which oil has been the major contributor, while at the same time meet its climate objectives that demand a future of much lower emissions. The economic, regional and political implications are huge, so any approach must carefully balance all the factors and consequences. The correct policy agenda should not only reflect today’s reality, but also create public recognition that either-or, black-and-white binary choices between the environment and the oil and gas economy are doomed to fail the test of economic and political sustainability.

The industry is clearly crucial to the national economy today and the question is how can that continue as part of a low emission future? If and when we get there depends on two things—whether the oil and gas sector continues to reinvent itself to be part of that future, and whether governments create the policy framework to help get us there. The starting point is to ensure a dispassionate, fact-based national understanding of the trade-offs and implications that come with reaching the future we all seek.

ISSN 2369-0224 (Print) ISSN 2369-0232 (Online)

References

2 2019-20 Energy Facts, NRCan

3 https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1410020201

4 (NRCan Energy Facts 2020)

5 (ibid)

6 p. 7, The Economist, May 23, 2020

7 https://www.worldoil.com/news/2019/11/13/iea-predicts-global-oil-demand-will-level-off-around-2030

8 https://www.iea.org/reports/oil-market-report-may-2020

9 https://tradingeconomics.com/canada/balance-of-trade

10 Canadian Press, March 29, 2020

11 https://www.sciencedirect.com/science/article/abs/pii/S0360319911003028

12 https://www.iea.org/commentaries/the-clean-hydrogen-future-has-already-begun

13 See Lee Beck, Clean Energy 2020, Vol. 4, No.1 2-11

Dale Eisler

Prior to joining the JSGS, Dale Eisler spent 16 years with the Government of Canada in a series of senior positions, including as Assistant Deputy Minister Natural Resources Canada; Consul General for Canada in Denver, Colorado; Assistant Secretary to Cabinet at the Privy Council Office in Ottawa; and, Assistant Deputy Minister with the Department of Finance. In 2013, he received the Government of Canada’s Joan Atkinson Award for Public Service Excellence. Prior to joining the federal government, Dale spent 25 years as a journalist. He holds a degree in political science from the University of Saskatchewan, Regina Campus and an MA in political studies from Vermont College. He also studied as a Southam Fellow at the University of Toronto, and is the author of three books, including Anton, a historical fiction novel that has been turned into a feature film.