Implications of the Global Solar Power Revolution for Canada's Energy Future

If Canada is to become an “energy superpower” it needs to make participation in the global clean electricity revolution a national priority. Seizing the rapid growth of solar energy will be key to securing a prosperous economic future.

By Peter Nicholson, Chair, Canadian Climate Institute, Member of the Order of CanadaSummary

|

Introduction

Download the JSGS Policy Paper

Download the Disussion Questions

Prime Minister Mark Carney, and others before him, have set an objective to make Canada an energy superpower, an objective implicitly taken to mean a “fossil energy superpower”. Indeed, Canada is already a globally significant producer and exporter of oil, gas, and coal. But is the world’s energy future destined to be dominated by fossil fuels? Few objective observers think so. That’s not because the world is at risk of running out of oil, gas, or coal; or even primarily because we need to mitigate the carbon emissions that are driving climate change. No—the global energy future will be dominated not by fossil fuels, but rather by cleanly-generated electricity because this is ultimately cheaper, less polluting, more energy-efficient, and unlike oil and gas, largely insulated from the vagaries of geopolitics.

The objective of this essay is to make the case why Canada should make participation in the global clean electricity revolution a national priority. Beyond the obvious need to help combat climate change, fully embracing the clean electricity transition is needed to secure a prosperous economic future.

At global scale, the clean electricity revolution that is now well underway is being driven primarily by solar power. The spectacular decline in the cost of transforming sunlight into electricity has emerged as a global economic game-changer that is too little understood outside expert circles. In this essay I focus on solar energy because that is where the global pace of change is greatest and where Canada’s participation is least. This is not to understate the essential and complementary roles to be played by wind and nuclear and other clean and cost-efficient electricity generation technologies. We need them all.

The paper begins by outlining the technological and economic underpinnings of the incredibly rapid global growth of solar power. This is followed by a brief section describing China’s leadership and the economic challenge this poses for the West, and particularly for the United States. The rest of the paper addresses the implications for Canada and specifically the under-recognized potential of solar-generated electricity to play a major role in making Canada a clean energy superpower.

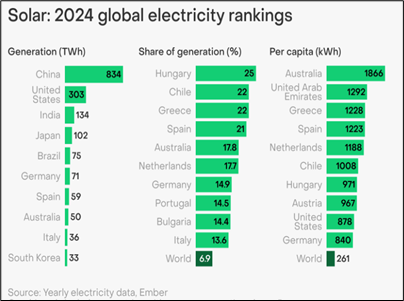

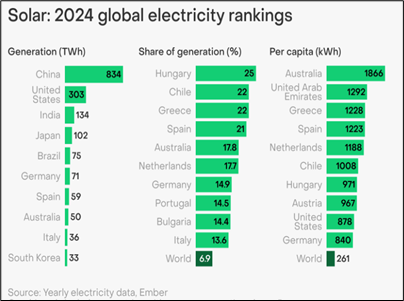

The Global Solar Energy Future

Will solar power eventually provide all the energy the world will ever need, and do so at a cost so low that almost no one on earth will ever again be forced into energy poverty? An article by New York Times commentator, David Wallace-Wells (What Will We Do With Our Free Power?), sets out the vision. He quotes Jenny Chase, the authoritative BloombergNEF analyst, predicting that by 2030 solar power will be reliably free during the sunny parts of the day for much of the year pretty much everywhere.The growth of solar installation globally is proceeding at a frenetic pace—e.g., in 2024, the world installed 585 gigawatts(GW).1 of new solar photovoltaic capacity, a 30% year over year increase to reach more than 2 terawatts (TW), enough in theory to fulfill the current electricity needs of about 800 million households globally.2 Solar constituted about three-quarters of the worldwide addition of renewable energy capacity. Globally, solar-generated electricity totalled 2,130 TWh in 2024, up 29% over 2023 and now supplying 6.9% of total electricity production. The growth of solar generation last year (474 TWh) was sufficient to meet 40% of the increase in global electricity consumption. Currently, 21 countries generate more than 15% of their electricity from solar facilities. In Canada, the share was only 0.9%.

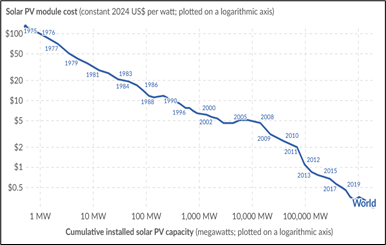

Why is solar energy investment booming globally? Fundamentally it’s because the cost of solar cells has been declining, literally exponentially, for the past 45 years thanks to a combination of materials science and economies of scale. This has reduced the cost of solar panel production from more than US$100 per watt in 1975 to as low as 10 cents currently in China, a thousand-fold cost compression. As a result, solar powered electricity has gone from an R&D lab phenomenon to a consumer product generating home-based electricity in the US at a cost of a few cents per kWh, depending on location.3 As solar panel cost has fallen, and will continue to fall, the panels themselves are making up a smaller and smaller share of the total cost of delivered electricity, currently only about a third. The rest is in the form of installation labour; DC to AC conversion; site preparation; taxes; profit margin; etc. (This omits battery storage, if applicable, and cost of land acquisition by a solar farm operator.) The plummeting cost of the panels themselves is no longer a valid indicator of the overall cost trend. Many of the other cost components, notably related to land and labour, are tending to increase. The key point to recognize, however, is that the economic incentive going forward—and therefore the focus of innovation—will be to reduce the non panel-related cost of solar energy. In the future we can expect to see the ever cheaper solar panels effectively being “wasted” in order to economize on other costs—e.g., more compact, easier-to-install arrays including robotic installation. That said, the pace of innovation in solar cell technology will also continue to make them cheaper, more efficient, and more flexible and durable.

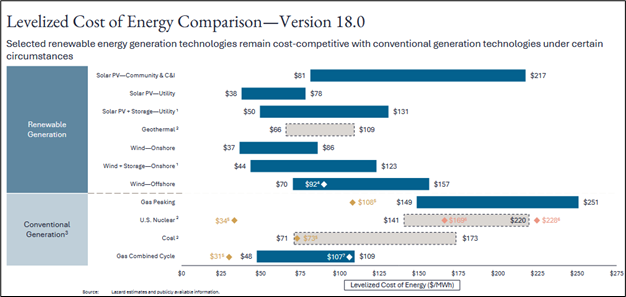

According to Lazard’s 2024 canvas of electricity generating cost in the US, the life-cycle average cost of clean renewable electricity, primarily solar and (onshore) wind, was the lowest among all generating technologies (see table, next page). For newly-constructed utility-scale solar, the range was 3.8-7.8 US cents per kWh, falling below the cost ranges for newly constructed natural gas, coal and nuclear plants. The addition of battery storage to smooth solar’s diurnal variation increases cost, ranging from 6.0 to 21 cents per kWh, but still competitive with natural gas peaking capacity. In the figure below, the “diamonds” refer to the average marginal costs of fully depreciated fossil and nuclear plants which tend to be lower than the solar + battery combo. However, the fossil combustion technologies are mature whereas solar generation will benefit from continuing technological advance, scale economies, experience curve effects, and the implicit value of secure and costless “fuel” supply together with minimal carbon emissions.

Source: Lazard’s Levelized Cost of Energy Analysis—Version 18.0 https://www.lazard.com/media/5tlbhyla/lazards-lcoeplus-june-2025-_vf.pdf

Source: Lazard’s Levelized Cost of Energy Analysis—Version 18.0 https://www.lazard.com/media/5tlbhyla/lazards-lcoeplus-june-2025-_vf.pdf

Lazard’s cost figures in respect of solar and wind generation have been criticized for not taking into account the full system cost of ensuring reliability of electricity supply in the presence of the variability and uncertainty of these intermittent resources, particularly as they become a larger share of generation. The full system cost depends on a host of factors that are specific to the electrical system in question and is inherently difficult to estimate. What can be said is that the effect of variability and uncertainty can be significantly mitigated by interconnection with other electricity systems; addition of storage (both short and long term); use of technology and pricing mechanisms to shape the demand for electricity; and by exploiting the complementarity between solar and wind generation patterns. As technology continues to improve, and as experience with integration of renewables accumulates globally, the cost penalty associated with accommodating the variability and uncertainty of wind and solar will continue to diminish.

In China—which has captured 80% of the world market for solar panels—solar currently accounts for a rapidly growing 8.3% of electrical generation while coal contributes 58%, a share that has fallen steadily from more than 80% in 2007. Solar now provides about 7% of US electricity and accounted for half the growth in generation in 2024. By contrast, solar contributed less than one percent of electricity generation in Canada, well below the shares in, for example, northerly countries like Germany (14.9%) and the Netherlands (17.7%), and sun-soaked Australia (17.8%). As explained more fully below, Canada’s latitude does not place the country at a significant disadvantage regarding cost-efficient solar energy.

The Global Competition to Dominate the Electrical Energy Transformation

Energy and innovation are ultimately the twin drivers of economic progress. China has concluded that the energy future will be dominated by electricity that is generated by clean sources—primarily solar, wind, nuclear and hydro—and has made a strategic commitment to leadership of the transformation. The motivation is not primarily to save the climate, but rather to exploit the advantages related to cost trends, security of supply, public health benefits associated with better air quality, and the superior efficiency of electricity as a source of energy.

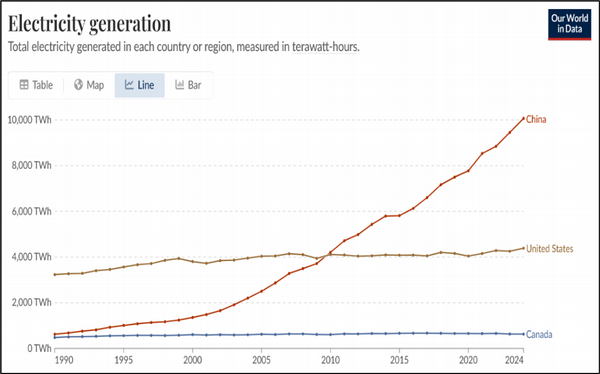

Consequently, China has gone all-in on electrification, accounting in 2024 for almost a third of global generation. Meanwhile, US electrical generation has barely increased in 25 years and in 2024 was only 42% of China’s. (Canada accounts for 2% of global electricity generation but is a high per capita user at four times the global average.)

Source: Ember (2025); Energy Institute - Statistical Review of World Energy (2025) https://ourworldindata.org/grapher/electricitygeneration?tab=line&time=1990..2024&country=USA~CHN~CAN

Source: Ember (2025); Energy Institute - Statistical Review of World Energy (2025) https://ourworldindata.org/grapher/electricitygeneration?tab=line&time=1990..2024&country=USA~CHN~CAN

In 2024, China generated 834 TWh of solar electricity, accounting for just under 40% of the global total and 2.75 times US solar generation. China’s lead continues to widen as it accounted for 53% of the world’s growth in solar energy production in 2024. China has turned its aggressive industrial policy toward clean electricity—massive investment in solar and wind equipment, including lithium batteries, and in electric vehicle manufacturing—in part to offset stagnation in its overbuilt real estate sector. As a result, China’s rapid advance in quality and price competitiveness has created a dilemma in the West where China’s vastly superior price performance accelerates uptake of imported clean technology but at the cost of dependency and decimation of home-grown capacity. Some tariff protection is justified in this circumstance but only if supported by other policy measures to stimulate domestic capacity and if ultimately time-limited.

As energy end use migrates toward electricity—because it is cheaper, more flexible, easier to move, and cleaner—the leaders in electricity supply and cost will achieve large and growing advantages in myriad use cases, thus transforming energy advantage into deep and broad-based economic advantage. China’s end-to-end dominance of the clean energy supply chain and of the electric vehicle market is a foretaste of what clean energy leadership can do.

The West, and particularly the US, cannot afford to cede the space to their economic and geopolitical rival. Fortunately, the incentive resulting from this competition provides the best, and probably the only, hope for rapid decarbonization of the global energy system which is also the only practical way to stabilize climate change. Nevertheless, the monumental scale of the transformation—in both engineering and financial terms, and further complicated everywhere by national politics—poses a daunting challenge to achieve global net-zero carbon emissions by 2050-60. In that regard, it’s unfortunate that the Trump administration’s energy policy has emphasized fossil fuels over solar and wind, although the latter continue to be supported by several States and are forging ahead thanks to private entrepreneurial initiative. It’s significant and profoundly ironic that Texas is, by several metrics, the solar and wind leader in the US despite its long domination by the oil industry and conservative politics. Alberta should take note.

Where does Canada stand?

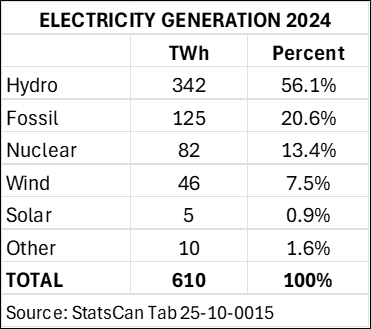

Canadian energy utilities have not made a meaningful commitment to wind generation, and particularly not to solar energy. In 2024, these sources provided only 7.5% and 0.9% respectively of Canada’s electricity.

This is short-sighted in view of the large increase in electricity demand that is virtually certain to occur over the next 25 years and beyond, driven by population and by new uses like electric vehicles, heat pumps, and data centres. How will this new demand be met? Although Canada is rich in hydro resources, accounting in 2024 for 56% of electricity generation, there are few remaining sites for large-scale hydro development. Nuclear, which currently supplies about 13% of our electricity, can provide increased base-load generation but faces technological and cost uncertainties in addition to public skepticism in many parts of the country. Fossil fuels, accounting for about 21% of generation (with natural gas about 18%), will face an increasing cost penalty relative to solar and wind as the latter become cheaper and as carbon emissions reduction is required. Both economic logic and climate objectives therefore imply that Canada’s energy growth—which will likely involve close to a doubling of electricity generation—should be met primarily by new wind and solar generation.

Table constructed by author from SC Table 25-10-0015

Table constructed by author from SC Table 25-10-0015

To provide a perspective on the implications, and purely for purposes of illustration, suppose that electricity generation were to increase from 610 TWh in 2024 to 1,000 TWh by 2050 with the increase distributed as follows: hydro up 20%; nuclear doubled; gas-fired generation reduced by 75% and coal and oil generation eliminated. If so, then solar, wind, and “other” sources (primarily biomass and geothermal) would need to supply about 40% of the generation in 2050—i.e., about 400 TWh—compared with about 10% in 2024. In this scenario, solar and wind would increase their electricity generation with a combined increase of roughly seven or more times their 2024 total of about 50 TWh. Even in an adjusted scenario where gas-fired generation did not decrease at all, clean renewables would still account almost a third of total generation in 2050. The point is that virtually any scenario for Canada’s electricity future implies a major role for wind and solar, and those sources must be counted on to supply most of the anticipated growth of electricity demand over the next 25-30 years.

Should Canada make a major commitment to solar electricity?

It is generally acknowledged that wind generation needs to increase very substantially in Canada, but the potential for utility-scale solar has gotten far less attention. In view of the global revolution in the economics of solar energy, Canada’s meagre commitment to that technology represents a risk in respect both of our climate goals and, particularly, our economic prospects. Solar’s growing cost competitiveness makes it more attractive than other major forms of generation—specifically gas and hydro—that are based on mature technologies and consequently have few if any really significant cost reduction opportunities.4 But is a major commitment to solar energy a genuinely practical option for Canada?

Canada’s northern latitude obviously reduces the annual energy generated per unit area of a solar panel relative to more southerly geographies. But the large solar installations in the Netherlands, Germany and other European countries already demonstrate that the technology can be competitive at northern latitudes. Note that Berlin and Amsterdam are north of Calgary, Regina and Winnipeg (and only a little south of Edmonton), yet Germany and the Netherlands already generate 15-17 per cent of their electricity from solar. Halifax and Montreal are south of Paris. Toronto is on the same latitude as Nice on the Mediterranean and only one latitude degree north of Rome.5

We have to put our minds in a near future when solar panels become “cheap as dirt”. This is what China has already demonstrated. It means that Canada will be able to afford to use more panels to make.

| Land Use for Solar Farms: Does land availability pose an important constraint on massive solar energy development in Canada? Current solar PV technology requires roughly 2,000-2,500 Ha (20-25 km2) of total land area to generate a terawatt-hour (TWh) of electricity in a year in Canada. (Estimates vary widely depending on location.) Canada currently (2024) generates about 610 TWh of electricity annually. Recalling the growth scenario described earlier, electricity demand will likely increase to at least 1,000 TWh by 2050. Assume for purposes of illustration that about half the growth—200 TWh—were to be solar-powered. The land use requirement would be about 0.5 million Ha (5,000 km2). Meanwhile, agricultural land in Canada totals 62 million Ha of which about 60% is actively cropped at any one time. But agricultural land and population, and thus energy demand, are very unevenly distributed—e.g., Ontario has about 8% of the agricultural land and 39% of the population whereas Saskatchewan has 40% of Canada’s farmland but only 3.4% of the population. Assuming (purely to illustrate relative magnitudes) that the demand for new electricity generation is proportional to population, Ontario’s new solar generation by 2050 (.39 x 200 TWh) could be sited on roughly 3.7% of the province’s current agricultural land with location concentrated on land of relatively low productivity. The corresponding figure for Saskatchewan would be about 6/100th of a percent. These very rough figures illustrate that potential land availability could more than compensate for Canada’s relative solar disadvantage in terms of northern latitude, particularly in the presence of new long-distance high-voltage DC transmission from the prairies. |

up for our northern disadvantage in energy-per-panel. For example, while Toronto gets about 30% less solar energy input than Los Angeles (averaged over the year), this could be offset in energy input terms by increasing the area of a solar farm in Ontario by a little more than 40% relative to California. But because the panels themselves are becoming an almost insignificant fraction of the total cost of electricity delivery to users, the increased area carries very little ultimate cost penalty. Instead, the cost of solar electricity will be dominated by other factors, some of which can be advantageous to Canada. For example, we have a comparative advantage in the cost and availability of land for the siting of utility-scale solar facilities—see Box below. At present, land use conflicts and NIMBY resistance have caused governments to shy away from major solar (and wind) installations but these objections can be met by siting away from heavily populated areas, including in the case of wind, by offshore installation. Of course this requires transmission infrastructure and associated cost trade-offs.

The cost of generating solar-powered electricity is only part of the story. To function as a major source of energy, ways are needed to smooth out solar’s daily and seasonal variation. Battery technology to offset diurnal variation will continue to benefit from cost-reducing innovation and global scale economies which have yielded exponentially diminishing cost. Canada will not be at a relative disadvantage in access to grid-scale battery storage.

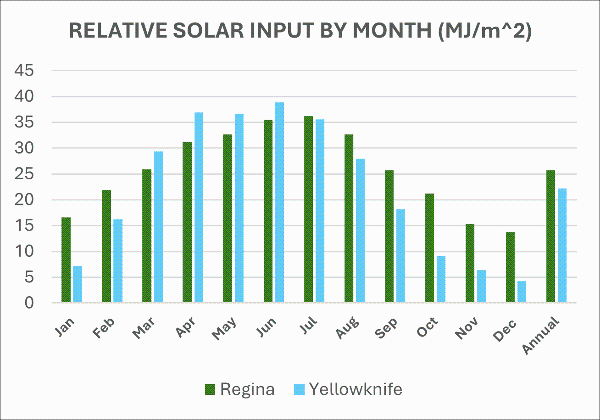

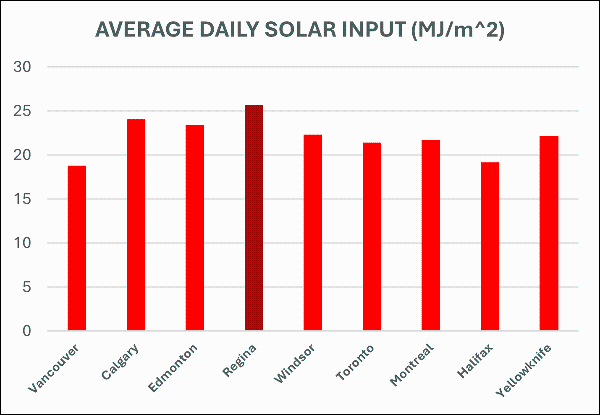

More challenging is the requirement to cope with the winter-summer seasonal variation in the output of a solar panel. This variation increases as you move north and becomes an increasingly serious challenge as solar power makes up a larger portion of grid supply. For example; in Regina, the input energy in December (16.6 MJ/day) is only 38% of the amount in July (36.2 MJ/day); whereas in Yellowknife the comparable ratio is a mere 11%.6 The seasonal variance generates a need for long-term smoothing, the extent of which varies somewhat by location—e.g., more in Yellowknife than in Regina but more in Regina than in Halifax. Electricity demand also varies seasonally and in Canada is generally higher in the cold months than in the warm ones—the opposite of the variation in the supply of solar energy. When solar has only low penetration, its seasonal variability can be easily accommodated by ramping up or down other existing generating resources, typically hydro and natural gas.

Source: Photovoltaic potential and solar resource maps of Canada Graphic created by the author

Source: Photovoltaic potential and solar resource maps of Canada Graphic created by the author

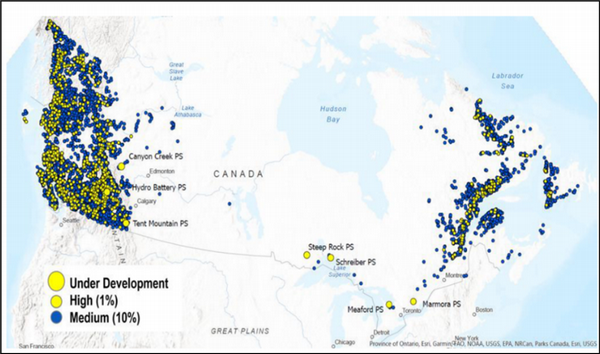

Arguably the best solution for long-term, high-volume storage is pumped hydro—using excess solar power in summer to pump water uphill from a low reservoir to a high one, then running it downhill through a turbine in the darker months to offset reduced solar output. A recent detailed analysis identified several thousand ideal sites for pumped hydro storage in Canada, particularly in BC, Newfoundland and Labrador, and Quebec (see Map). The storage potential is effectively unlimited in engineering terms.7

Source: Technical and Economic Potential Assessment of Pumped Storage Hydropower in Canada (p 3) stantec_ps_final_en.pdf

Source: Technical and Economic Potential Assessment of Pumped Storage Hydropower in Canada (p 3) stantec_ps_final_en.pdf

A National Vision for Renewable Energy

Hydro complementarity—involving both existing generation facilities and engineered pumped storage—provides a significant made-in-Canada advantage in the context of massive solar (and wind) electrification. In western Canada, the solar and wind advantage of Alberta and Saskatchewan could be complemented by the hydro resources of BC and Manitoba—hence the importance of expanding interties among the western provinces as foreseen in the recent Memorandum of Understanding between the federal and Alberta governments. Similarly, in the eastern half of the country, hydro in Labrador and Quebec would be an ideal complement to solar and wind. In addition to solar facilities in southern parts of Ontario and Quebec, there is unlimited technical potential for wind energy generation off the Atlantic coast. In that case, the balance between wind and solar supply would depend on the relative cost of generation and transmission as well as the economics and politics of land use for solar and wind installations as compared with massive offshore, out-of-sight, wind farms.

The problems created by the intermittency of solar-generated electricity can be further mitigated by planned “overbuilding” (as the cost of panels declines) so as to generate more energy in the morning and evening when demand is high. This will increase the surplus generation during the mid-day hours, leading to lower pricing in that time period and an incentive for users to shift consumption, where feasible, to times when solar energy is most abundant. Even the winter-summer variance could be mitigated by overbuilding with cheap solar panels.

The point that cannot be overemphasized is the enormous stimulus to innovation, on both the supply and demand sides, that is being created by the plummeting cost of converting light into electricity. In effect we are witnessing a phenomenon analogous to what “Moore’s Law” did to drive the infotech revolution—i.e., the exponential reduction over many years in the cost a transformative technology.8What’s holding us back?

- First and foremost, it’s the sheer inertia of the status quo. Electricity production is understandably a conservative and regulated industry in view of the importance of reliable and affordable energy for the economy and for everyday lives. Canadians are accustomed to cheap and secure electricity. Why mess with success?

- The balkanizing effect of provincial jurisdiction inhibits the regional and national co-operation needed to capture many of the benefits of solar and wind generation—particularly interprovincial collaboration on capacity planning and transmission that would lead to a maximally efficient and reliable grid and resulting mutual economic benefit. Put simply: provincially-siloed capacity planning and investment has lacked national vision.

- Electricity demand has been increasing very slowly in Canada, as efficiency gains have offset the effect on demand of population growth. This will change with the major electrification of transportation, building heating, and industrial processes as well as the rapidly growing demand from data centres that is likely to be supercharged by AI. But until that new demand can be confidently estimated, why invest in major new supply? Meanwhile, the potentially massive new demand awaits stimulation by the availability of cheap abundant electricity—i.e., a chicken or egg type of impasse.

- Utility planners do not perceive that solar generation is a priority relative to other sources like hydro, nuclear, fossil, and even wind; all generation technologies where Canada has extensive experience and, in the case of natural gas, a regional preference in some parts of the country. Our latitude is understandably seen as a relative disadvantage for solar, particularly due to seasonal variation and the fact that power demand is greater in winter than summer. These concerns are well founded but are being rapidly eroded by the technological innovation and scale economies of the global solar industry. Wayne Gretzky’s insight is relevant: “We need to skate to where the puck’s going to be.”

- A separate factor, ironically, is the sheer pace of cost-reducing innovation. Why not wait another five years and a dynamic technology like solar power might be a lot cheaper and even more reliable?

Yet as Canada equivocates other countries like Australia, Germany, the Netherlands, China, and the United States (at the State and local levels), are forging ahead. We already know that our reluctance to embrace clean renewable energy as a matter of national priority is undermining our commitment to combat climate change. Unfortunately—despite fires, floods, and heat waves—too many Canadians still see climate change as a distant threat that Canada, as a comparatively small contributor, can do little about. Consequently, the transformational renewable energy opportunity has become embroiled in the polarized politics surrounding climate change.

What has not been recognized is that the transition to renewable solar and wind energy is about Canada’s economic future. The world is “electrifying”, and renewables—particularly solar—are driving the transition. The incentive is ultimately rooted in the growing economic superiority of renewable energy generation in terms of both cost and security of supply. Since energy, along with innovation, are the ultimate drivers of progress, those nations that are in the vanguard of the renewable energy revolution will be tomorrow’s leaders. Canada is blessed with the resources to be among those leaders.

To be an energy superpower of the future, Canada needs to go where the world is headed, not to where it has been.

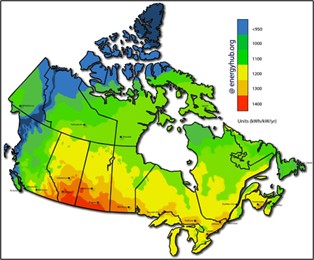

ANNEX: Overview of Canada’s Solar Energy Resource

Virtually every place in Canada, including the far north, can generate meaningful amounts of solar energy. The variation illustrated on the map is due to a combination of latitude and average atmospheric conditions—e.g., relative presence of clear and cloudy skies. Areas with lower annual solar input can generate as much annual electricity as areas with higher input by employing more solar panels since a larger collector area can offset lower solar power input per unit of area. It comes down to cost, and as the price per watt of solar collection continues to decline so does the economic disadvantage of being in a relatively low-sun area.

Source: https://www.energyhub.org/solar-energy-maps-canada/

Source: https://www.energyhub.org/solar-energy-maps-canada/

Annual average solar input in Regina (among the sunniest places in Canada) is only about 20% greater than in Toronto and Montreal, indicating that these two cities could approximately match Regina by installing 25% more collector area per capita. Remarkably, Yellowknife receives about 85% as much solar energy annually as Regina, and about the same amount as Windsor (which lies slightly south of Detroit.) The difference of course is seasonal variation. The land of the midnight sun in summer is also the land of the mid-day dark in winter when heating demand is also greatest. Compensating for the seasonal variation of solar energy input is a bigger challenge in Canada than coping, via batteries, with daily day-night variation. Wind generation is complementary—stronger in winter than summer—but pumped hydro, either into existing reservoirs or purpose-built sites, can address seasonal variability and enable solar power to form a major component of Canada’s future electricity supply.

Source: Photovoltaic potential and solar resource maps of Canada Graphic created by the author

Source: Photovoltaic potential and solar resource maps of Canada Graphic created by the author

Endnotes

[1] To put this in context, 585 gigawatts (GW) of solar capacity would generate about 820 terawatt hours (TWh) of electrical energy in a year, or an amount equal to 135% of Canada’s total annual electricity production from all sources (610 TWh) in 2024. Averaged globally and over a year, current solar cells generate only about 16% of the maximum capacity indicated by their wattage rating. The reduction is due to diurnal, seasonal, geographical and atmospheric variation—e.g., a 1 kW panel would typically deliver about 1,450 kWh of electrical energy annually in Canada (before system losses), an amount that varies by location—e.g., about 1,570 in Toronto; 1,350 in Vancouver; 1,100 in Whitehorse. This is compared with an average of 1,970 in California and 1,400 in New York State.

[2] This assumes a global average capacity factor of 16% and global average annual household electricity consumption of 3,500 kWh per household. The average in Canada is much higher at about 12,000 kWh.

[3] The cost per watt of a bare panel is of course not a valid indicator of the cost of a solar facility. The fully installed cost of residential photovoltaic solar power in the US is currently about $3/watt (before government incentives), of which the panels themselves cost about $1 but will decline very significantly. The cost per kWh is about 6-8 cents.

[4] It is hoped that designs for small modular reactors (SMRs) will eventually lower the cost of nuclear generation, but almost surely not below that of solar. The advantages of SMRs are for base load and distributed siting so they will have a role provided the techno-economics work out. Innovation in wind generation, particularly for offshore facilities, promises continuing cost reduction but not to the same degree as solar.

[5] Note that it is latitude, not temperature, that primarily determines the annual total input of solar energy. Average cloud cover also plays a role which is why sunny Regina is so well-suited for solar generation.

[6] The data in the chart is annual average daily solar energy received by panels with solar angle tracking on two axes. Units are megajoules per square meter. To convert to kWh per square meter, divide by 3.6. For example, Regina receives an annual average of 2,605 kWh per square meter (25.7/3.6 *365). The comparable figure for Yellowknife is 2,250 kWh; and for Toronto 2,170 kWh. The amount of energy received by a solar panel depends on its orientation with respect to incoming sunlight. Two axis tracking is most efficient but also costlier.

[7] The analysis identified more than 8,000 GW of very high potential sites—an amount of potential energy storage almost 100 times greater than existing conventional hydro capacity in Canada. The most attractive potential sites were identified based on water supply, topography, environmental suitability, Indigenous title, access to existing transmission lines, and other factors that affect the cost of construction—e.g., providing access roads. The study found that about 85% of the sites could realistically be developed between now and 2035.

[8] Computing technology has improved in power, and reduced in unit cost, by millions of times since the 1960s. The lowest current cost per watt of a solar collector (US10 cents/watt in China) is now almost a thousandth what it was in 1975. While this cost reduction does not approach what happened in information technology, the reduction to date is already sufficient to revolutionize clean energy generation. Current (crystalline silicon) solar cell technology is mature, but a next generation of “perovskite” cells has the potential to reduce the cost by another factor of 4 (to 2-3 US cents per watt). Cost reduction is due not only to technology innovation but also to the “experience curve” effect whereby increased production volume results in falling unit cost.

Peter Nicholson

Peter Nicholson has served in numerous posts in government, business, and higher education. His public service career included positions as Clifford Clark Visiting Economist in Finance Canada; Deputy Chief of Staff, Policy in the Office of the Prime Minister; and Special Advisor to the Secretary general of the OECD. Dr. Nicholson’s business career included senior executive positions with Scotiabank and BCE Inc. He retired in 2010 as founding president of the Council of Canadian Academies, an organization that conducts expert panel studies of scientific issues related to public policy. He is currently the Chair of the Board of the Canadian Climate Institute. Dr. Nicholson is a Member of the Order of Canada and the Order of Nova Scotia and is the recipient of six honorary degrees.

(The views expressed are those of the author and should not be ascribed to the Canadian Climate Institute.)